Understanding the Role of Data Analytics in Coin Sales

How Data Analytics Transforms Coin Sales

Imagine cracking open a treasure chest, and instead of gold coins, it’s brimming with data insights. That’s the magic of using data analytics in coin sales—it turns numbers into actionable strategies that fuel your success. Whether you’re selling rare collectibles or modern bullion, the role of analytics isn’t just helpful; it’s transformational.

For starters, data analytics helps you uncover hidden patterns. Are certain coins flying off the shelves in specific regions? Is there a seasonal spike in demand for commemorative pieces? With tools like predictive analytics, you can anticipate trends before your competitors do. Think of it as peering into a crystal ball—minus the guesswork.

And let’s talk personalization. Analytics allows you to slice and dice your customer segments with surgical precision. Want to know which customers are most likely to buy that 1921 Morgan Dollar? You got it. Using purchase histories, browsing habits, and even engagement metrics, you can craft targeted offers your buyers simply can’t resist, making every interaction feel tailor-made.

In short, data analytics is your most powerful ally in making informed decisions that turn coin sales into gold mines. Who doesn’t want that?

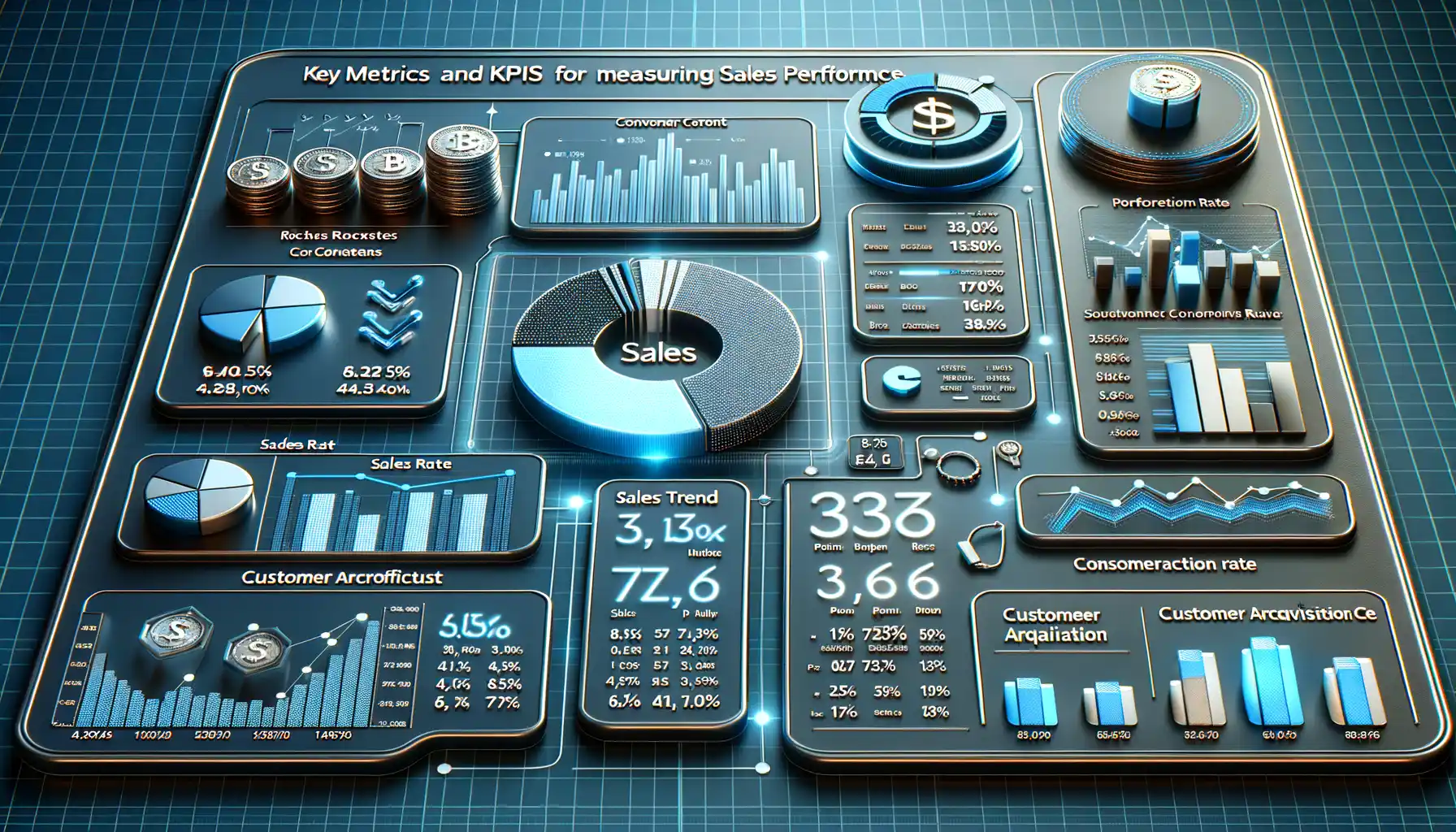

Key Metrics and KPIs for Measuring Coin Sales Performance

Understanding the Numbers Behind the Shine

When it comes to assessing the success of your coin sales strategy, the magic isn’t in the mystery—it’s in the metrics. Measuring performance is like peering through a jeweler’s loupe: you’ll uncover details that can make or break your strategy. To get the full picture, some key metrics should be on your radar.

- Sell-through Rate: Think of this as your litmus test for demand. How quickly are your gold coins, limited editions, or commemorative pieces flying off the shelves?

- Average Order Value (AOV): This is your goldmine insight (pun intended). It shows how much customers are spending per purchase and hints at opportunities for upselling higher-value coins or bundles.

- Customer Retention Rate: Coins are collectibles for many, so keeping buyers coming back is like striking recurring gold in a deep mine.

The Metrics That Tell a Story

Sure, numbers are numbers—until they’re not. For instance, a rising conversion rate paired with a stagnant AOV could mean collectors are opting for lower-value pieces. Or maybe your new customer acquisition rate is soaring, but repeat purchases are slipping. Each metric comes with a narrative, and your job is to read between the lines. Data isn’t just cold, hard facts; it’s a treasure map.

Strategies for Applying Data Insights to Boost Coin Sales

Turn Numbers into Nuggets of Gold

Data isn’t just numbers; it’s a treasure map. Every trend, every figure, is a golden clue about your coin buyers. But how do you transform these insights into real sales? Let’s dig in.

First, analyze purchase patterns. Are customers snapping up rare coins right after payday? Or maybe they’re drawn during auctions or promotions? Use these details like breadcrumbs to time your campaigns perfectly. It’s not about guessing—it’s about spotting habits and riding the wave.

Second, slice your audience into segments. Instead of treating all customers the same, group them: newbies vs seasoned collectors, budget-conscious buyers vs high rollers. Tailored messaging works wonders. For instance: a casual buyer might jump at a low-risk offer, while a whale will appreciate exclusive access to rare pieces.

- Send personalized email recommendations based on past purchases.

- Create urgency with timed offers when engagement is high.

- Leverage geolocation data to tap into trending coins regionally.

The goal? Make every interaction feel bespoke, like handing someone the perfect coin they didn’t even know they wanted.

Predict, Don’t React

Let’s talk predictive analytics—your secret weapon against stagnation. By studying historical data, you can anticipate demand spikes before they happen. Imagine launching a limited collection right when interest peaks, rather than scrambling to catch up later.

Use tools like machine learning algorithms, which analyze thousands of customer behaviors faster than you can say “numismatics.” It’s like having a crystal ball—only better because it’s rooted in hard facts.

And don’t forget social listening data! If you spot buzz around a particular design or historical event, why not lean into it? Make that design shine in your marketing efforts or offer educational tie-ins. Your audience will feel seen, and your sales will soar.

Common Challenges in Using Analytics and How to Overcome Them

Breaking Through Data Overwhelm

Analytics can feel like stepping into an infinite library where every book is open, and the pages keep multiplying. For many coin sellers, it’s not just about having data—it’s about knowing *what* to do with it. One major challenge? Data overload. You might collect metrics on customer demographics, buying patterns, and even time-of-day sales spikes. But here’s the kicker: without a clear purpose, this can snowball into confusion.

Start small. Focus on a few key questions, like “Which coins sell best during special promotions?” or “What’s my most profitable sales channel?” By narrowing your lens, you can create clarity from chaos.

Another struggle? The dreaded “wrong tool for the job.” Perhaps you’re trying to analyze coin sales using spreadsheets when what you really need is a dedicated analytics platform. Investing in tools like Google Analytics or a specialized CRM dashboard may feel daunting, but trust me—it’s worth it.

- Find tools that integrate with your existing processes.

- Set automations to track essential metrics (so you don’t have to).

- Experiment with free trials before committing.

Remember: the goal isn’t drowning in data; it’s rising above it with sharp, actionable insights.

Overcoming Skill Gaps in Data Interpretation

Got plenty of data but no idea how to interpret it? You’re not alone. Many coin sellers get tripped up by the “what now?” phase after collecting their shiny new insights. It’s like being handed a treasure map…without knowing how to read it.

Here’s the truth: you don’t need a PhD in data science to make sense of analytics. Start by teaming up with experts. Consulting a data analyst—even on a short-term basis—can act as a shortcut through the learning curve. Alternatively, invest in online resources or quick workshops to understand terms like “conversion rate” and “customer lifetime value.” These aren’t just buzzwords; they’re the North Star for scaling success.

Also, don’t hesitate to ask questions of your tools. For instance, many systems now come with built-in explanatory features. A program might tell you, “This week’s dip in sales is linked to fewer repeat buyers,” which helps you course-correct immediately.

The secret sauce? Stay curious and never stop testing assumptions. In the world of analytics, growth lies at the intersection of trial, error, and breakthrough moments!

Future Trends in Data-Driven Coin Sales Strategies

The Revolution of Predictive Analytics in Coin Sales

The future is bright, and it’s also data-driven. Imagine knowing not just what your customers bought but predicting *exactly* what they’ll want next. With advancements in predictive analytics, that fantasy is becoming reality. Harnessing AI-powered tools, coin sellers can now analyze purchasing patterns, seasonal demand shifts, and even trending historical interests.

Here’s the magic: algorithms can forecast hot-selling coins before the market even notices them. For example, a sudden spike in searches for collectible coins from a specific period (say, the Roman Empire) could indicate an upcoming surge in demand. As a seller, wouldn’t you love to stay one step ahead of that trend? This isn’t just reacting; it’s anticipating.

- AI-driven insights to identify rising trends in coin categories.

- Advanced customer segmentation based on preferences and buying habits.

- Real-time data dashboards for immediate adjustments to marketing strategies.

Hyper-Personalization: Tailoring Sales Like Never Before

Forget cookie-cutter sales pitches. The future lies in hyper-personalized outreach. Picture this: a longtime client who adores 19th-century American silver coins receives a curated newsletter highlighting rare finds *just* for them. Personal touches like these, driven by customer data, turn casual buyers into loyal collectors.

Beyond email campaigns, think tailored social media ads. A collector searching for “rare gold doubloons” might see highly targeted ads featuring precisely those treasures. By focusing on individual desires, you’re not just selling coins—you’re crafting experiences. That’s the power of data, taken to its fullest potential.